Table Of Content

- Zoopla: Average UK Property Price Hits Record Level

- August: Price Growth Lowest Since 2012 – Zoopla

- January: ‘Slow Burn’ Rise In Demand As Price Growth Slows

- What is an equity mortgage?

- May: Outlook Uncertain As Prices Edge Down – Zoopla

- November: Relief for borrowers as Bank rate stays at 0.1% – for now

The rise meant that average property prices were £24,500 higher at the end of 2021 compared with a year earlier. This contributed to a 7.6% rise in the overall annual growth rate for average house prices to January. Rightmove said the last time this figure was exceeded was when it reached 8.3% in May 2016. Average house prices in the UK stood 10.8% higher in December 2021 compared to the previous year.

Zoopla: Average UK Property Price Hits Record Level

In response to the latest figures from Halifax, estate agents and property experts remain cautiously optimistic that the market is moving in the right direction and that price falls could start to slow. Annual house price inflation is down by 2% for London, where the average property price is now at £540,800. While annual house price inflation is down in 12 out of the 20 cities where data is recorded by Zoopla, some areas appear to be more resilient than others. Annually, house prices are down 3.4%, although this rate of decline was slower than in September, when the annual fall in prices was 4.5%. The average UK house price was £281,974 in October, representing a £3,000 increase in one month.

August: Price Growth Lowest Since 2012 – Zoopla

Equity release calculator - The Telegraph

Equity release calculator.

Posted: Thu, 28 Mar 2024 07:00:00 GMT [source]

Despite increasing economic headwinds, characterised by soaring inflation and rising interest rates, combined with a cost-of-living squeeze, Zoopla said that the housing market had remained resilient. The Nationwide house price index reported that the value of an average UK home rose by 11% to £271,209 in the year to July 2022. The annual rate of growth was higher than the 10.7% it calculated the previous month.

January: ‘Slow Burn’ Rise In Demand As Price Growth Slows

On an annual basis, prices among new sellers are up by 0.1% compared to February 2023. While it’s only a whisker increase, it marks the first time that annual prices have been in positive territory after six consecutive months of falls. Regions in the south of England (including the South East, South West and East of England) have recorded the biggest annual price falls nationally. Average property prices in the East of England region are down by 2.1%, prices in the South West are down by 1.7%, while prices in the South East are down by 1.9%, year on year.

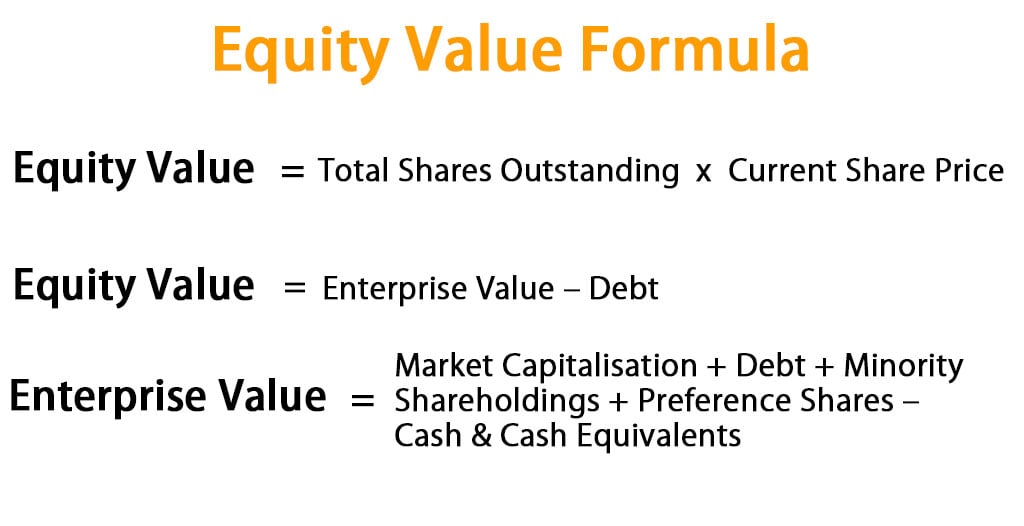

What is an equity mortgage?

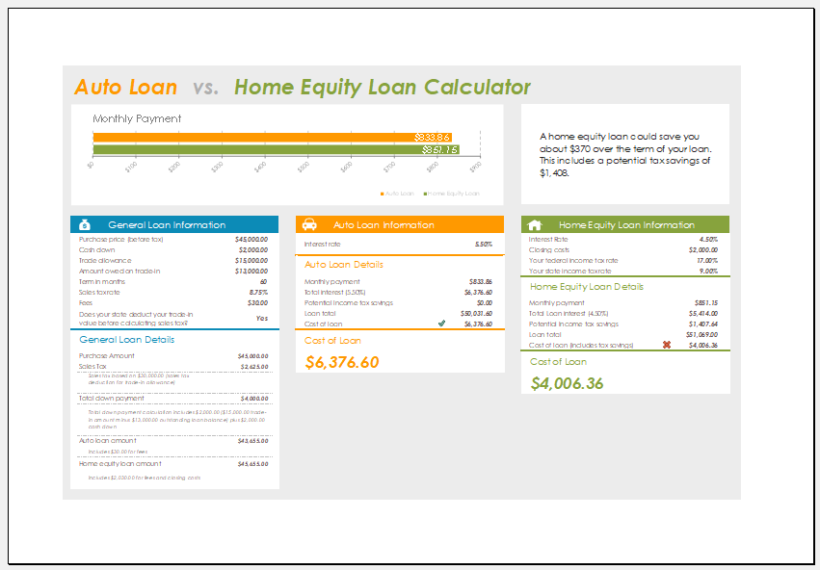

This means that even homeowners who made small down payments or who have only owned their home for a few years may already be eligible for a home equity loan. If you take out a home equity loan, you will probably have to pay some type of loan origination fee. Interest rates are also generally higher for second mortgages and home equity lines of credit (HELOCs) than for the original mortgage. After including these transaction costs, the amount of home equity you can really use is lower than the amount you have in theory. A cash-out refinance allows you to refinance your home for more than what you still owe on your existing mortgage and receive the extra amount as a lump sum payment. Taking this option might allow you to get a lower interest rate than a home equity loan.

Current HELOC & Home Equity Interest Rates - Forbes

Current HELOC & Home Equity Interest Rates.

Posted: Thu, 22 Feb 2024 08:00:00 GMT [source]

Rightmove: Price Rises Typical For September – While Demand Is Up

The interest on borrowing with your home equity is generally tax deductible if funds are used to improve the home. If all or part of your home is funded with a mortgage loan, the mortgage lender has an interest in the home until you pay off the loan. Like a home equity loan, you take out the equity in your home in a lump sum with a cash-out refinance. Instead of having two separate loans, a cash-out refinance consolidates what you owe into one mortgage. You could save money if you refinance your mortgage debt at a lower interest rate. A cash-out refinance replaces your existing mortgage with a brand new, larger loan, allowing you to spend the difference.

Despite having the least affordable homes in the UK overall, Westminster and the City of London have experienced the greatest improvement in affordability since the start of 2020. Halifax suggests increased demand for rural homes is the main driver for this change. The region with the biggest drop in affordability between 2020 and 2022 was Pembrokeshire. In the first quarter of 2022, the area’s price-to-earnings ratio stood at 6.9, compared with 4.3 at the beginning of 2020. Driving the sharp increases is a shortage of available properties and high tenant demand.

HMRC said August’s figure was also 20% higher than the one recorded for the corresponding month in 2020. It estimated the provisional, non-seasonally adjusted figure for UK residential transactions in August 2021 at 106,150. Having removed a full-blown stamp duty holiday from England and Northern Ireland at the end of June, the UK government withdraws its remaining framework of tapered stamp duty reliefs at the end of this month. The ONS also said that hospitality workers were the most likely to be furloughed during the pandemic.

November: Relief for borrowers as Bank rate stays at 0.1% – for now

This site does not include all companies or products available within the market. At Bankrate, our mission is to empower you to make smarter financial decisions. We’ve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure our content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

Say you have a $200,000 mortgage at 3 percent and you want to tap $50,000 of your home equity. A cash-out refi would require you to pay off the old loan and take a new loan for $250,000 at a much higher rate. And while it’ll probably be at a higher interest rate, it’ll be charged on only $50,000.

“There are tentative signs of a slowdown, with the number of mortgages approved for house purchases falling back towards pre-pandemic levels in April and surveyors reporting some softening in new buyer enquiries. Economic and political uncertainty is prompting buyers across the board to lock in their mortgage rates for the longer term – especially as there is no longer a discernible difference in cost. Rightmove has revised its full-year 2022 house price forecast from 5% to 7% growth, as monthly values climbed for the sixth consecutive month. The value of an average home in the UK increased by 12.8% in the year to May 2022, according to the latest data from the Office for National Statistics (ONS) – a rise from 11.9% recorded in the year to April. But the property portal, Zoopla, said that the price of an average UK home rose by 8.3% to £256,600 in the year to June 2022, a drop from the figure of 8.7% it reported a month earlier.

A home equity loan lets you borrow from the equity that you’ve built in your home through mortgage payments and appreciation. You receive the money all at once with a fixed interest rate, making it a solid choice if you know exactly how much you’ll need to borrow. For example, you might choose a home equity loan if you’re replacing your roof or putting in new carpet. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

A home equity loan or home equity line of credit (HELOC) both allow you to borrow against your ownership stake in your home, or your equity. The equity is the difference between what you still owe on your mortgage and what your home is worth. Generally, the interest rates on home equity products are lower compared to other forms of financing like credit cards.

This in turn would feed into mortgage borrowing rates, with improved affordability stoking demand and stimulating price growth further. While London saw a fall in prices of 2.4% in the first quarter of 2024, year on year prices are still up by 1.6%. Average property prices in the capital are the highest of any UK region at £519,505.

The government says this risk would be mitigated by setting a cap on the number of housing association properties that can be sold, while committing to replacing each home sold. This will extend the scheme, under which council house tenants can buy their property, to an additional two million people. The set of standards that rented social housing must meet — the Decent Homes Standard — will be extended to private sector rented homes.

No comments:

Post a Comment